Table of Contents

- New tax brackets for 2024 | FOX 5 DC

- Tax season 2024: Everything to know from deadline to extensions ...

- Brenda Arriaga on LinkedIn: 2024 Tax Brackets

- The New 2024 Tax Brackets for the US: Explained - YouTube

- Capital Gains Tax Rate 2025 Zimbabwe - Omar Lila

- Tax Brackets for 2024 vs. 2025: How Much Will They Change?

- 2024 Tax Cuts: New Stage 3 Tax Brackets Explained

- Tax Landscape 2024: What You Need to Know About Recent Changes ...

- How Project 2025 could impact your tax bracket and capital gains under ...

- NEW INCOME TAX BRACKETS FOR 2024 ANNOUNCED BY IRS - America’s best pics ...

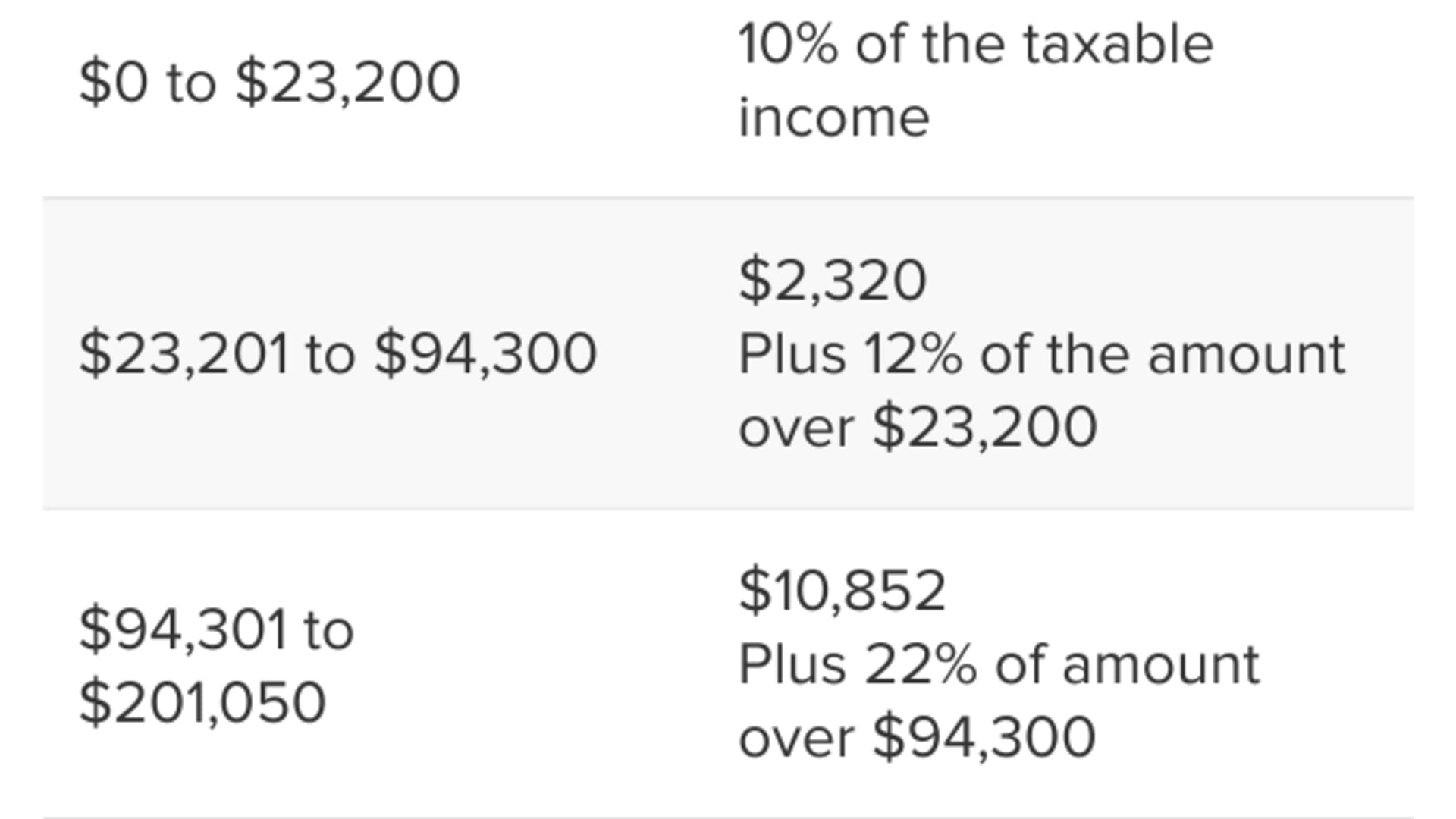

Tax Brackets and Rates

Standard Deductions

Retirement Contribution Limits

The IRS has also adjusted the contribution limits for retirement accounts, such as 401(k) and IRA plans. For tax year 2024, the contribution limits are: $22,500 for 401(k) and other employer-sponsored retirement plans $6,500 for IRA plans These increased contribution limits will allow taxpayers to save more for retirement, potentially reducing their taxable income and lowering their tax liability. The IRS tax inflation adjustments for tax year 2024 will have a significant impact on various tax provisions, including tax brackets, standard deductions, and retirement contribution limits. Taxpayers should be aware of these changes and how they may affect their tax situation. By understanding these adjustments, taxpayers can better plan their tax strategy and potentially reduce their tax liability. It is essential to consult with a tax professional to ensure compliance with the new tax laws and regulations.For more information on the IRS tax inflation adjustments for tax year 2024, visit the IRS website. Stay informed and up-to-date on the latest tax news and developments to ensure you are taking advantage of all the tax savings opportunities available to you.